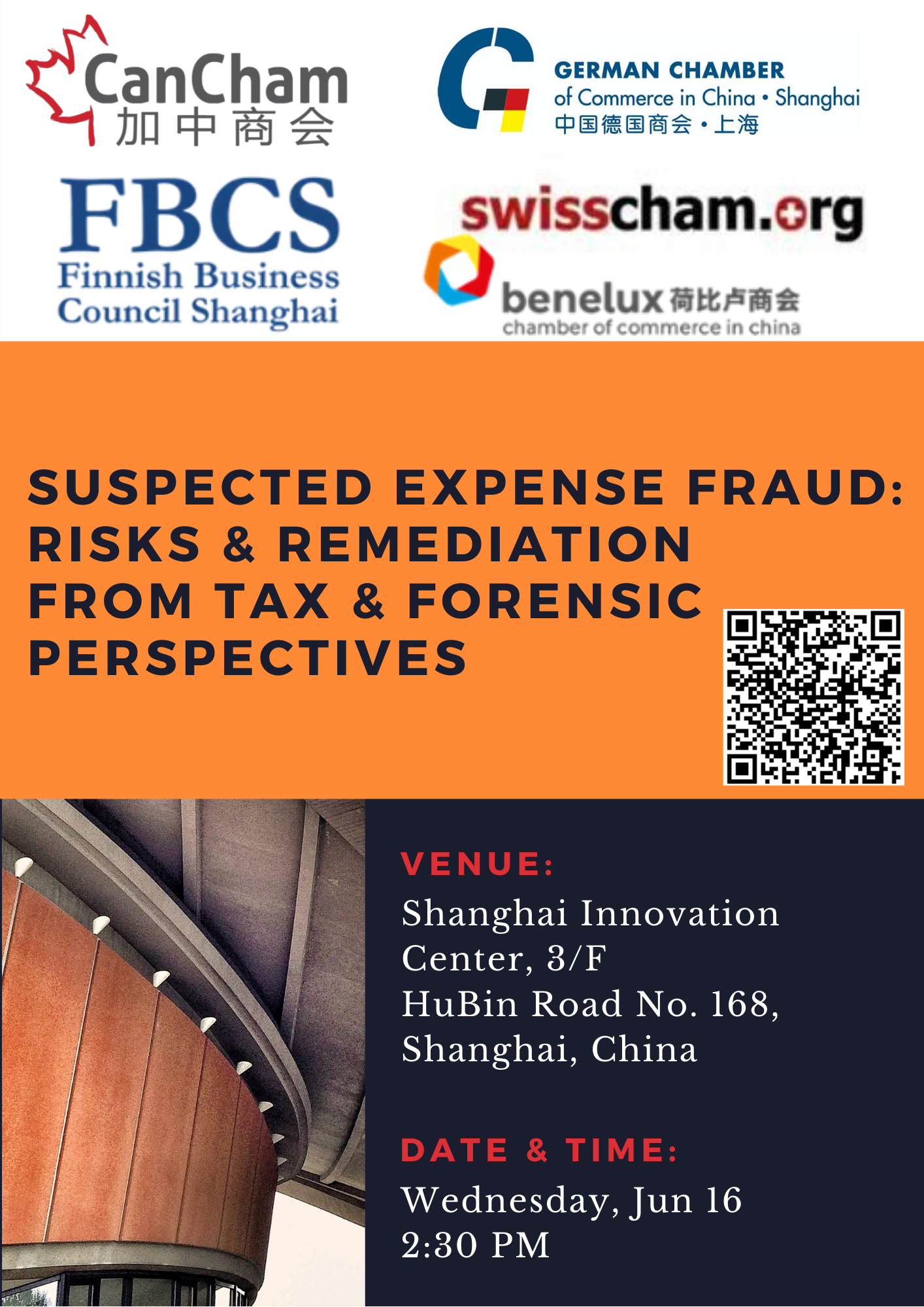

Jun 16 | Suspected Expense Fraud: Risks and Remediation from Tax and Forensic Perspectives

PwC: Building relationships, creating value

According to PwC’s Global Economic Crime Survey, 60% of China-based respondents said that they had been affected by fraud, corruption or other economic crimes during the previous two years. This is much higher than the global average and other countries in the region.

Increasingly, fraud issues in China are being brought to light by external factors and parties, such as external whistle-blowers, police investigations, and tax authority inquiries. When a suspected fraud comes to light, especially when under an external authority’s scrutiny, what do companies need to do to establish the facts, take appropriate measures, and minimise impact?

We are delighted to invite you to join our seminar where PwC Tax and Forensic specialists will share their experience of real-world scenarios. For instance, a recent case involves local tax authorities initiating inquiries into a foreign company, in relation to suspicious fapiaos issued to company. The fapiaos were issued by shell companies and used by employees to claim business expenses. The company was required to gather information and respond to the authorities within a very tight timeframe.

The PwC specialists will share considerations in regards of dealing with tax authorities and conducting internal information gathering to assess fraud and compliance risks.

Speaker:

Paul Tan

Partner at PwC Forensic Services at PwC

Based in Shanghai, Paul Tan has been helping clients to respond to and protect against fraud and corruption in China since 2004. He is a specialist in conducting forensic accounting, economic crime, and anti-bribery and anti-corruption (ABAC) engagements. In particular, he has performed a large number of compliance assessments and compliance consulting related projects, and has extensive experience in responding to whistle-blower allegations, regulator inquiries and other incidents. He has also helped a range of clients to enhance their compliance programs in China, and to conduct business ethics trainings.

Paul has worked with clients and their legal advisors across a wide range of industries. He has deep cross-cultural understandings of the Chinese and Western business environments, and is bilingual in English and Mandarin Chinese.

Paul holds degrees from the University of Cambridge and London School of Economics and is a fellow of the Association of Chartered Certified Accountants.

Bill Yuan

Partner at PwC Tax at PwC

Bill Yuan has extensive experience in corporate restructuring, M&A and market entry advice for foreign investors, including forming joint ventures. Bill has assisted a range of clients across different industries in tax health checks and buy-side tax due diligence. In recent years, Bill has also been actively engaged in providing transfer pricing advice to his clients and preparing for transfer pricing defence.

Bill obtained his Bachelors degree from the Shanghai University of Finance and Economy. He is a member of the Association of Certified Public Accountants and Association of Certified Tax Agents of the PRC.

Venue:

Shanghai Innovation Center, 3/F

HuBin Road No. 168, Shanghai, China

Date:

Wednesday, Jun 16, 2021

2:30 PM – 4:30 PM

Ticket:

Free for CanCham Members

Not Open for Non-Member

Registration: (You may register until Monday, June 14, 2021 or as long as there are seats available)

https://cancham.glueup.cn/event/suspected-expense-fraud-31809/

or scan the QR code on the poster

Organizer: