Are Expatriates in Shanghai subject to Social Insurance dues?

The following article was written by CanCham member, SONG Co., Ltd.

All foreigners working in China are subject to the Social Insurance Contribution. Shanghai is the exception, only because there is a specific principle here that allows employers and foreign employees to choose whether to contribute or not. This principle will soon expire on August 15th 2021.

Back in 2009, the Shanghai Municipal Human Resource and Social Security Bureau issued a notice—2009 Shanghai Notice— stipulating that foreign employees in Shanghai may (neither shall nor must) contribute in the basic pension, health, and work-related injury insurances. In practice, employers and their foreign employees have often reached an agreement to opt out of the social insurance contribution.

Later in 2010, the PRC Social Insurance Law was promulgated. Pursuant to the PRC Social Insurance Law, all foreign nationals employed within the Chinese territory shall participate in the social insurance system with reference to the provisions under the law. While there exist inconsistencies between national law and local rules, the aforementioned flexible practice in Shanghai has not yet been officially abolished. Nevertheless, the 2009 Shanghai Notice will expire soon on August 15th 2021, according to another extension notice. Unless further extended, the Shanghai local rules will not be applicable anymore after that date and employers and foreign employees will not be able to agree to opt out the social insurance contribution.

From a purely legal perspective and as national laws prevail over provincial/local rules and regulations, the flexibility granted under the 2009 Shanghai Notice was granted/practically accepted even though it is infringing upon the general obligation for/by foreigners to contribute under the Social Insurance Law.

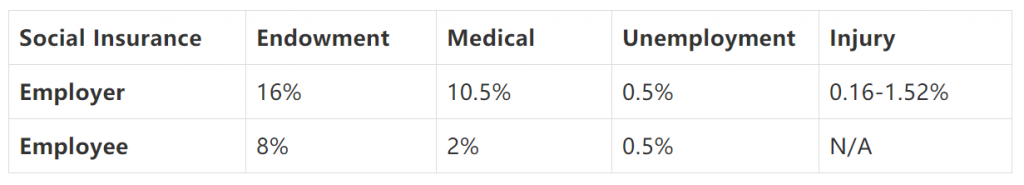

To sum up, pursuant to the PRC Social Insurance Law, foreign employees in Shanghai and their employers are in principle obliged to pay the statutory social insurance contributions if not exempted by applicable treaties. Before August 15th 2021, based on the currently applicable Shanghai policy, they were still able to agree on whether to contribute to three insurances or not (pension, health insurance, and work-related injury insurance). However, the future of the exception in Shanghai is uncertain for the time being.

*The calculation base for the social insurance in Shanghai is announced on July 9th, 2021. The application of this new standard will start in July 2021.

- The minimum calculation base is CNY 5,975/month and,

- The maximum calculation base is CNY 31,014/month.

The average monthly wage is CNY 10,338/month, calculated from the data of YR 2020.